Philip Hergel

Senior Quantitative Analyst

Download the full piece here.

A very wise, thoughtful and exceptionally caring woman once told me “All dining tables should be round”. Puzzled, I asked her why? She responded matter-of-factly “because you can always squeeze in another body at a round table”. That spirit of inclusion has been lost to an overwhelming atmosphere of conflict and angst, resulting in a fragile economy that is top-heavy and brittle, propped up by a few while so many struggle. When we prioritize the well-being for the many rather than the luxury of the few, we create a more stable society and economy. We need to get back to the spirit of the round table, where everyone has a place.

What is a K-shaped Economy?

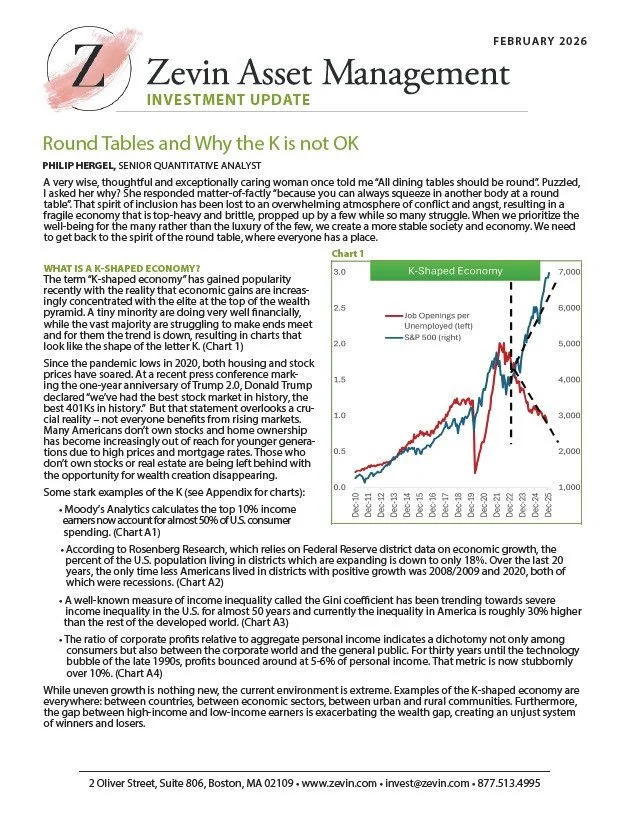

The term “K-shaped economy” has gained popularity recently with the reality that economic gains are increasingly concentrated with the elite at the top of the wealth pyramid. A tiny minority are doing very well financially, while the vast majority are struggling to make ends meet and for them the trend is down, resulting in charts that look like the shape of the letter K. (Chart 1)

Since the pandemic lows in 2020, both housing and stock prices have soared. At a recent press conference marking the one-year anniversary of Trump 2.0, Donald Trump declared “we’ve had the best stock market in history, the best 401Ks in history.” But that statement overlooks a crucial reality – not everyone benefits from rising markets. Many Americans don’t own stocks and home ownership has become increasingly out of reach for younger generations due to high prices and mortgage rates. Those who don’t own stocks or real estate are being left behind with the opportunity for wealth creation disappearing.

Some stark examples of the K (see Appendix for charts):

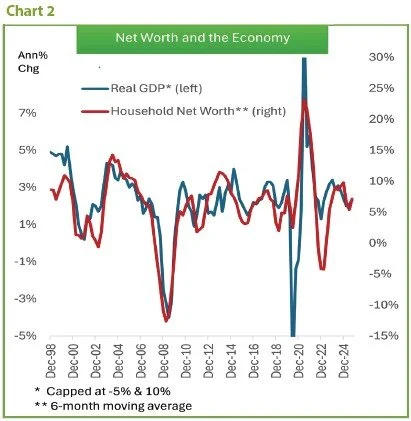

· Moody’s Analytics calculates the top 10% income earners now account for almost 50% of U.S. consumer spending. (Chart A1)

· According to Rosenberg Research, which relies on Federal Reserve district data on economic growth, the percent of the U.S. population living in districts which are expanding is down to only 18%. Over the last 20 years, the only time less Americans lived in districts with positive growth was 2008/2009 and 2020, both of which were recessions. (Chart A2)

· A well-known measure of income inequality called the Gini coefficient has been trending towards severe income inequality in the U.S. for almost 50 years and currently the inequality in America is roughly 30% higher than the rest of the developed world. (Chart A3)

· The ratio of corporate profits relative to aggregate personal income indicates a dichotomy not only among consumers but also between the corporate world and the general public. For thirty years until the technology bubble of the late 1990s, profits bounced around at 5-6% of personal income. That metric is now stubbornly over 10%. (Chart A4)

While uneven growth is nothing new, the current environment is extreme. Examples of the K-shaped economy are everywhere: between countries, between economic sectors, between urban and rural communities. Furthermore, the gap between high-income and low-income earners is exacerbating the wealth gap, creating an unjust system of winners and losers.

So What?

While overall aggregate economic growth in the U.S. remains solid (real GDP grew 2.3% in the third quarter of 2025 from year ago levels), some argue the dichotomy is irrelevant and “trickledown economics” will eventually benefit the losers. The problem with this argument, however, is that it has never worked (“trickledown” starts with “trick” after all.) As Bruce Springsteen sings in his song Badlands, “Poor man wanna be rich, rich man wanna be king, and a king ain’t satisfied, until he rules everything.” Historical evidence shows us concentrated wealth tends to remain concentrated as the wealthy invest in financial assets to benefit themselves.

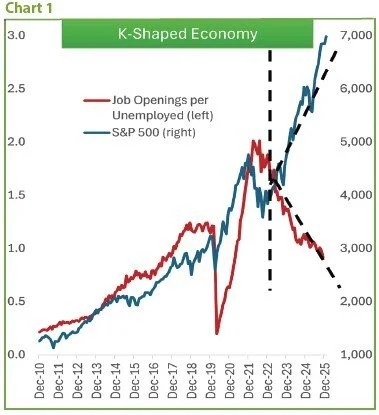

An economy in which the top 10% of earners account for almost half of all consumption and that consumption is dependent on equity-market wealth is vulnerable to falling stock prices. A significant decline in equity prices can rapidly erode wealth and confidence, leading to reduced discretionary spending. Given that consumer spending is by far the largest component of GDP in America, a spending pullback by this relatively small group can trigger a sharp slowdown in aggregate demand and therefore the economy as a whole. Essentially, if household net worth is tied to equities and if equity prices fall then the economy is vulnerable to a slowdown or even recession (Chart 2). What makes this situation more worrisome is there are many reasons to be concerned about a setback to equities:

· Equities are expensive and extremely vulnerable to a minor correction leading to a major slide.

· The S&P 500 is unusually dependent on a handful of mega-cap AI-related stocks, which are priced for perfection. Any disappointment in the AI theme could pull markets down disproportionally.

· The world is almost one year into a trade war, and we’ve already witnessed equities pulling back with every threat of escalation.

· The Federal Reserve’s independence is under attack which threatens the bedrock of the global financial system.

· Geopolitics is heating up with growing concerns about annexations around the world from varying antagonists.

· The emergence over the last year of a “sell America” themed trade.

Bottom line: A K-shaped economy is not only unjust, but also economically unsafe. Consumer spending drives GDP growth and it’s dangerous when consumption is concentrated in the few at the top who are dependent on equities to maintain their wealth and confidence. Should equities correct, so too will the willingness to spend. Broadening opportunity and strengthening the bottom of the income scale would result in more inclusive growth, stabilize demand and reduce economic risks. Programs such as guaranteed minimum income, increased tax credits or simply enacting living wage laws would all help in this regard. Shared progress is far superior to concentrated gains. Just as round tables allow for inclusion at the dinner table, which benefits the group, inclusion in wealth gains for everyone benefits the health of the overall economy.

Appendix

Disclosures: Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal. This communication is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational and illustrative purposes. This communication may include opinions and forward-looking statements. All statements other than statements of historical fact are opinions and/or forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. All expressions of opinion are subject to change. You are cautioned not to place undue reliance on these forward-looking statements. Any dated information is published as of its date only. Dated and forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any dated or forward-looking statements.