Marcela I. Pinilla

Director of Sustainable Investing

Download our Q2 2022 Impact Update.

At Zevin Asset Management, we build responsible investment portfolios to satisfy our clients’ goals. We then address risks and create positive social impact by engaging with portfolio companies. This quarter, we wrapped up the 2022 proxy season and continued to build on past engagement successes. As we make progress, we also identify and seek to address emerging challenges. Please see the end of our update for a summary of the proxy season.

Covering our bases

Russia’s horrific invasion of Ukraine led us to consider more broadly the investment risk and human rights implications of holding positions in countries with authoritarian regimes. We have always had a policy not to invest in Chinese companies that were majority owned or controlled by the Chinese government. However, we feel that this doesn’t go far enough and have decided to divest from and cease further investment in direct Chinese and Hong Kong holdings for the foreseeable future. We remain rooted to our sustainable investment approach and are hopeful that others will follow through on their convictions as well. Our statement on this decision is here.

Efforts aimed at discrediting ESG investing are on the rise in the U.S. and much of these efforts are unfolding behind the scenes through corporate lobbying. Corporate contributions and membership dues to trade associations fuel the lobbying power of Republicans who plan to block the SEC from adopting ESG regulations in the upcoming midterm elections. Another major blow to progress is the Supreme Court’s ruling limiting the EPA’s ability to curb emissions and combat climate change. In response to the country’s weakened climate strategy, we remain steadfast in our work engaging companies to mitigate and report on their emissions.

On all of the above issues, we continue to leverage our investor voice to lean on companies to stand up and protect human rights, reform our institutions, and promote systems of accountability.

Linking compensation to DEI-related outcomes with Kroger

After filing a proposal with Kroger—the largest supermarket chain by revenue—seeking ESG-linked pay, we continued our dialogue with the company to discuss our expectations moving forward. Kroger has since committed to integrating metrics related to diversity, equity, and inclusion (DEI) into their compensation plan. As a result, part of Kroger’s manager and executive pay, from associates to senior managers, will be tied to employee feedback, as well as the attraction, retention, and promotion of employees. As we continue to engage Kroger going forward, our objective is to strengthen accountability and hold the company to its commitments on racial equity and transparency of worker data.

In other news: Zevin Asset Management weighs in

At Zevin Asset Management, we actively lend our investor voice to other individuals and institutions seeking to create positive social change. In the second quarter of 2022, we supported social change by:

Testifying along with numerous organizations before the EPA in support of clean trucks. Pressure to set strong regulations on heavy-duty trucks must continue, given their strong contribution to greenhouse gas (GHG) emissions.

Joining a letter calling on the U.S. Chamber of Commerce and its members to cease blocking critical climate and energy policy. We were disheartened by the U.S. Chamber of Commerce’s efforts to defeat the Build Back Better legislative package and its statements opposing the SEC’s proposed climate disclosure rule. These actions directly contradict the organization’s public statements supporting the goals of the Paris Agreement.

Joining the Global Investor Statement to Governments on the Climate Crisis which encourages governments to engage closely with investors to make sure that climate risks are effectively managed and that opportunities are fully realized.

Looking ahead

As we plan for the 2023 proxy season, it is paramount that we reflect on this season’s outcomes and events. We anticipate that these will undoubtedly shape our advocacy agenda. Looking at our approach broadly and in detail, our 2022 Impact Report showcases our efforts to contribute to positive change over the past two years and our perspective and leadership from that period. Zevin Asset Management continues to be active in corporate engagements, listening to advocacy organizations on the ground, and participating in forums, panels, and advisory sessions that contribute to our collective work.

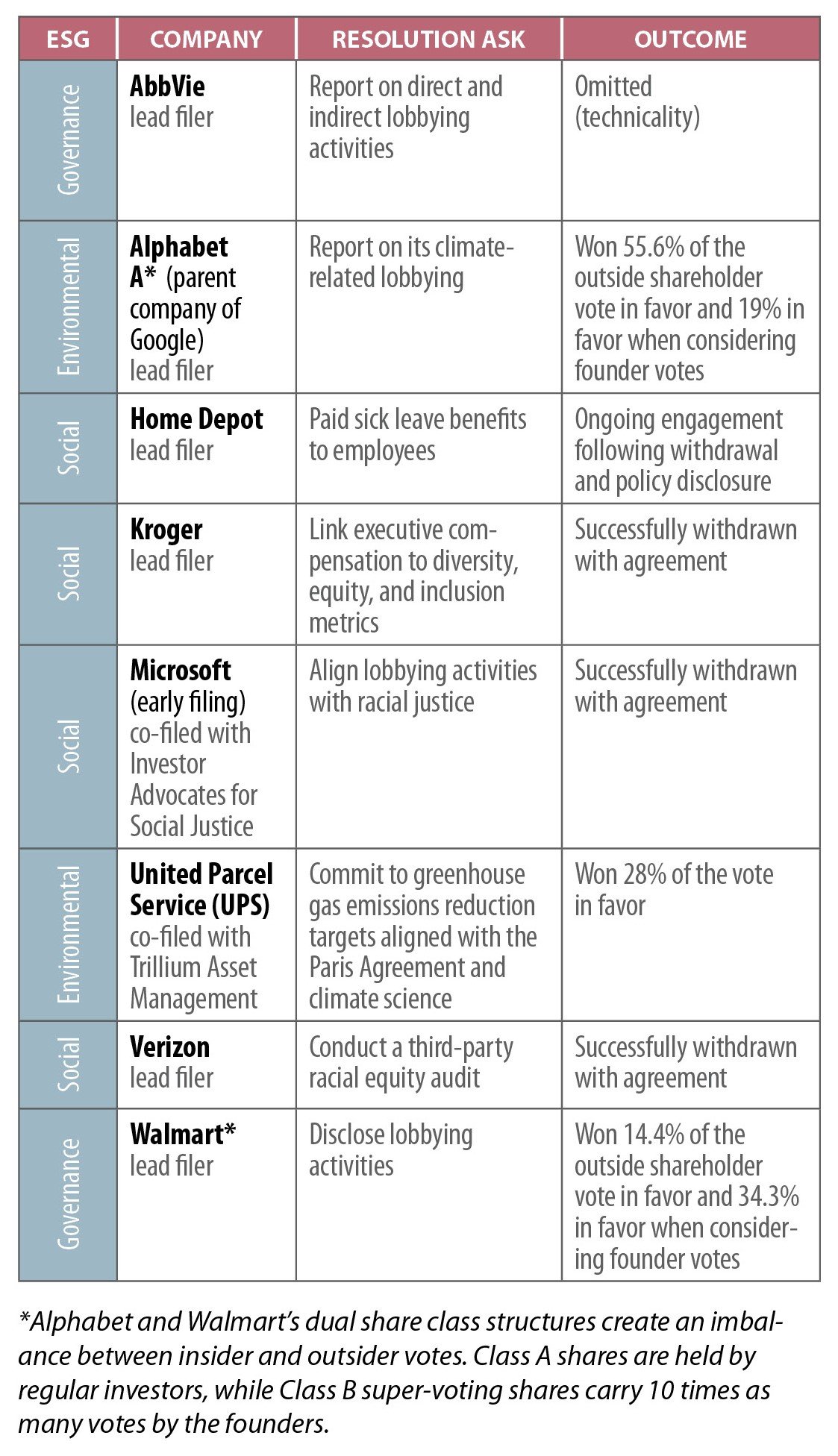

Summary of Zevin Asset Management’s 2022 proxy season

Thank you for reading and sharing. For more on this work and our broader advocacy, visit our website, and join us on Twitter and LinkedIn. And please don’t hesitate to contact Marcela Pinilla, Zevin Asset Management’s director of sustainable investing, at marcela@zevin.com with your questions, thoughts, and suggestions.

Disclosures: Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal. This communication may include opinions and forward-looking statements. All statements other than statements of historical fact are opinions and/or forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. Unless stated otherwise, any mention of specific securities or investments is for hypothetical and illustrative purposes only. Zevin Asset Management’s clients may or may not hold the securities discussed in their portfolios. Zevin Asset Management makes no representations that any of the securities discussed have been or will be profitable.