Click here to download a pdf of this brief.

Marcela Pinilla Director of Sustainable Investing & Philip Hergel Senior Quantitative Analyst

As long-term investors, we view immigration as a powerful driver of economic innovation and long-term value creation. Despite escalating anti-immigrant sentiment and increased enforcement activities, immigrants—documented and undocumented alike—make substantial contributions to the U.S. tax base, labor force, consumer demand, and entrepreneurship. Immigrants paid $652 billion in federal, state, and local taxes in 2023¹, equivalent to 2.3% of U.S. GDP and more than the entire economies of countries like Belgium or Argentina. This capital is vital for public infrastructure, schools, healthcare, and retirement systems. Notably, undocumented immigrants pay a higher average effective tax rate than the top 1% of households.²

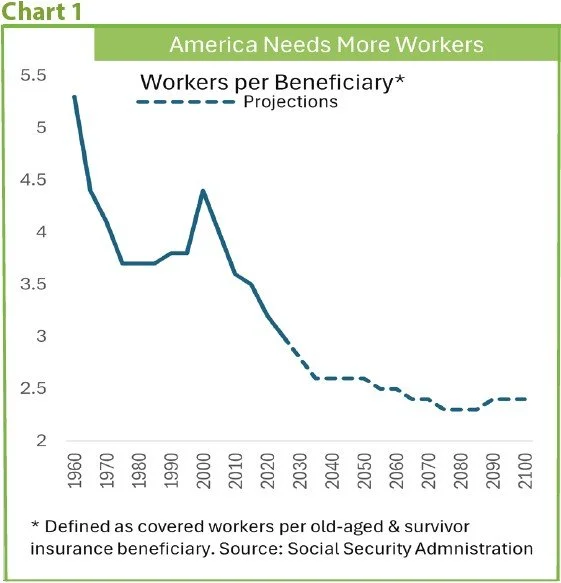

The fiscal benefits are especially clear concerning Social Security. With an aging population and declining fertility rates leading to fewer workers, Social Security benefits are projected to face reductions by 2033.³ Immigration is one of the most effective tools to offset this demographic imbalance, which is caused by an aging native-born population and declining birth rates. The U.S. Census Bureau projects that with lower-than-expected immigration, the population would decline in 20 years, and with zero immigration, it would decline next year, severely harming economic growth.⁴ This outcome would shrink the labor force, erode economic output, and increase fiscal strain on public programs. Immigration is therefore critical to keeping the system solvent and protecting the benefits we all have paid into (Chart1).

Anti-immigration policies also pose material risks to key sectors for investors. Immigrants, comprising only 14% of the population, make up 25.7% of construction workers and 26.1% of agricultural workers.⁵ These sectors are fundamental to the broader economy, underpinning housing supply, infrastructure, and the U.S. food system. Disruptions from deportations, raids, or fear-driven labor shortages can slow economic activity and fuel inflationary pressures, causing significant short-term labor shortages, operational delays, and increased costs in areas like food processing and construction.⁶ These effects ripple through supply chains, impacting industries such as food services, transportation, hospitality, and childcare and elder care.

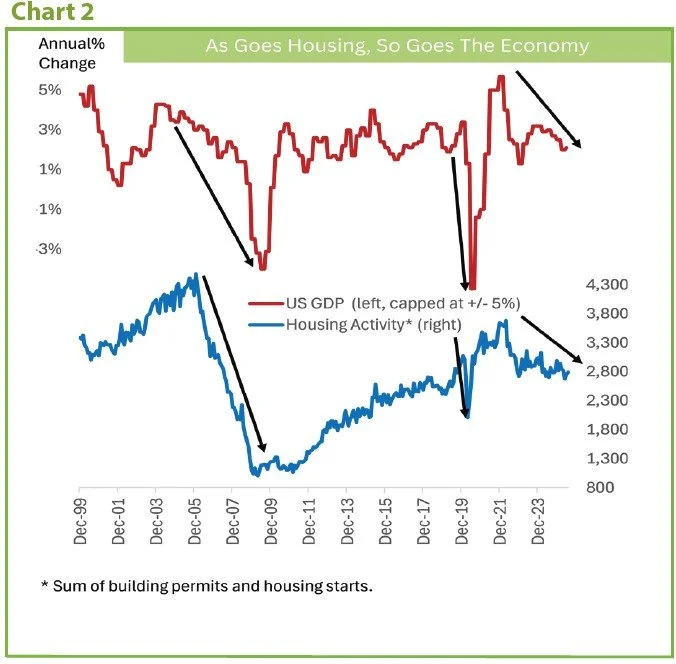

Housing development, which is crucial to economic growth and is already constrained by a shortage of skilled labor, is particularly vulnerable to labor shocks from worksite raids and deportations, exacerbating structural bottlenecks and increasing business and systemic risk⁷ (Chart2). Furthermore, undocumented immigrants have an estimated spending power of approximately $300 billion,⁸ and losing laborers could lead to a significant reduction in consumption, with secondary and tertiary effects as companies struggle, close, and cause job losses, further constraining spending.

The idea that immigrants "take jobs" or "reduce wages" is a myth repeatedly debunked by economists.⁹ Instead, immigrants often complement native-born workers, fill labor shortages, and increase demand in local economies.¹⁰ Immigrants even have a positive effect on wages for their less educated American-born peers.¹¹ Countries like Spain have benefited from openness to immigrants, boosting domestic demand and rejuvenating their workforce.¹²

Despite these clear economic advantages, narratives rooted in fear, ignorance, and economic insecurity fuel opposition to immigration, leading to policy choices that harm immigrant families and undermine long-term value creation. The government's current prioritization of immigration enforcement, spending fourteen times more on enforcement than on agencies protecting labor standards, allows employers to take advantage of fear to prevent workers from reporting workplace harassment, wage suppression, or safety concerns.¹³ Increased funding for border security, expanded detention and deportation, attacks on due process, and higher costs for work permits and reduced visa periods all multiply hardship for immigrants and employers.¹⁴

As we monitor and engage our portfolio companies, we apply a human rights lens to uncover risks and harm stemming from direct and indirect involvement in immigration enforcement and detention activities. Companies can be involved through supplying the technology and AI capabilities that enable surveillance, censorship, and/or targeting of individuals as well as through partnerships with third parties that enable the detention of people with the use of AI-enabled mapping technology.

Download Immigration: An Asset, Not a Liability.

We are engaged with stakeholders in building awareness and action among investors in seeking measures from companies to mitigate operational, legal and reputational risks. We are also questioning due diligence processes related to providing services and products that support surveillance systems, predictive policing, and the militarization of AI.

As fiduciaries, we have a duty to address the long-term social and economic risks of immigration policies. Encouraging inclusive policies that enable immigrant communities to fully participate in the economy unleashes productivity, expands the tax base, and stabilizes key programs like Social Security.

We can learn so much from friends, allies and even foes from around the world. What an utterly boring existence it would be if we all had the same backgrounds, traditions, tastes and experiences. Not only do we benefit economically from immigration, we gain interesting, diverse and shared experiences. At Zevin Asset Management, we know as much. Ten of our fifteen staff, and eight of nine Investment Committee members are immigrants or first-generation Americans.

As Bruce Springsteen poignantly sang in his tribute to immigrant labor in his song American Land:

“They died building the railroads, worked to bones and skin.

Died in the fields and factories, names scattered in the wind.

Died to get here a hundred years ago, they’re dying now.

The hands that built the country we’re always trying to keep down.”

We owe it to those hands—and to the future of our economy—to ensure our policies and investments reflect our values and understanding of what drives prosperity.

We welcome your questions and comments at invest@zevin.com

1. https://map.americanimmigrationcouncil.org/locations/national/

2. https://americansfortaxfairness.org/undocumented-workers-pay-higher-effective-tax-rate-55-mega-corporations-several-billionaires/

3. https://bipartisanpolicy.org/explainer/immigration-social-security-solvency

4. https://www.census.gov/newsroom/press-releases/2023/population-projections.html

5. https://immresearch.org/publications/states/

6. https://www.axios.com/2024/11/19/undocumented-workers-immigration-deportation-trump

7. https://www.nahb.org/news-and-economics/press-releases/2025/06/new-study-reveals-significant-economic-impact-of-housing-industry-labor-shortage

8. https://www.americanimmigrationcouncil.org/press-release/immigrants-keep-economy-strong-as-congress-debates-mass-deportation/?utm_source=chatgpt.com

9. Bloomberg, accessed August 8, 2025

10. https://www.nationalacademies.org/our-work/economic-and-fiscal-impact-of-immigration

11. https://www.brookings.edu/articles/immigration-and-the-macroeconomy-after-2024/

12. https://www.nber.org/system/files/working_papers/w32389/w32389.pdf

13. https://elpais.com/economia/2025-01-29/la-economia-espanola-crecio-un-32-en-2024-por-el-tiron-del-turismo-y-la-inmigracion.html

14. https://www.epi.org/publication/immigration-enforcement-and-the-workplace

15. https://www.nahb.org/news-and-economics/press-releases/2025/06/new-study-reveals-significant-economic-impact-of-housing-industry-labor-shortage

Disclosures: Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal. This communication is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational and illustrative purposes. This communication may include opinions and forward-looking statements. All statements other than statements of historical fact are opinions and/or forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. All expressions of opinion are subject to change. You are cautioned not to place undue reliance on these forward-looking statements. Any dated information is published as of its date only. Dated and forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any dated or forward-looking statements.