Philip Hergel

Senior Quantitative Analyst

Whatever happened to the old saying “don’t fight the Fed”? Typically, when the Fed and other central banks raise interest rates to cool inflation, an associated and necessary result is economic activity and corporate earnings slow, so equity markets sell off in response. But year-to-date the global benchmark All Country World Index (ACWI) has returned almost 10% and has largely ignored the fact that we are still in the midst of the most aggressive monetary tightening cycle since the 1980s. Starting in the first quarter of 2022, the central banks of the G10 largest economies have increased policy rates by a whopping 24% in aggregate. Meanwhile, central banks are also withdrawing stimulus through their quantitative tightening programs. But all the while stock markets have spent 2023 so far merrily (or recklessly?) marching higher.

Chart 1.

How Did We Get Here?

At the onset of the COVID-19 pandemic and accompanying economic shutdown, global central banks acted aggressively to cut interest rates and embarked on massive unconventional stimulus in the form of quantitative easing. Meanwhile, governments around the world provided their own fiscal stimulus in the form of emergency spending to assist families, employers, and local governments. The International Monetary Fund (IMF) estimates the fiscal stimulus measures in developed economies amounted to 15%-20% of their GDP in 2020. That was a massive amount of money floating around looking for things to buy!

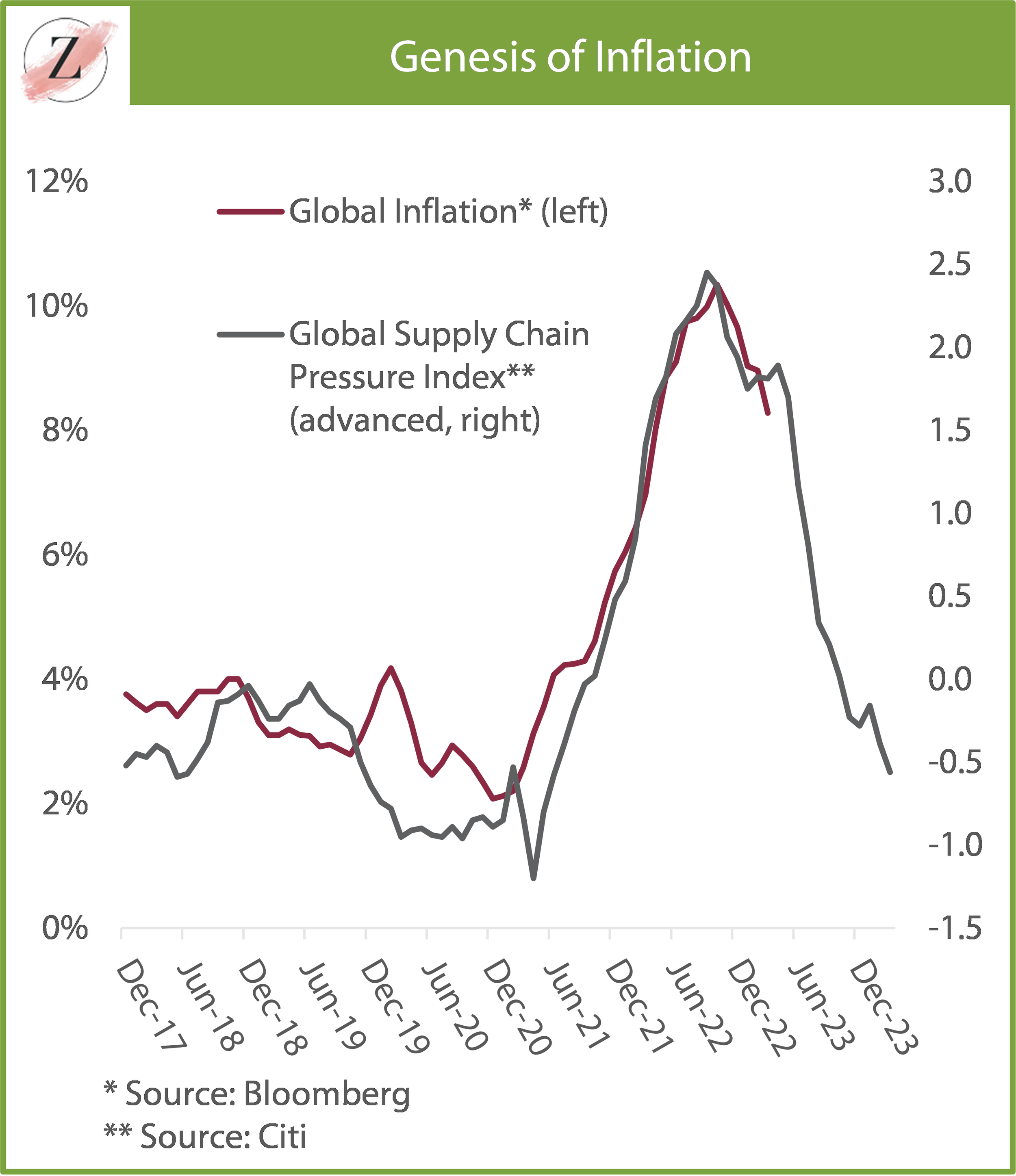

As economies opened up in 2021 and consumers were eager to spend their new stimulus checks, it became obvious that this pent-up demand had a hard time finding goods to buy due to supply-chain disruptions. As a result, a mismatch developed of too much demand for too little supply and intense inflation resulted, particularly for goods (Chart 1).

Chart 2.

As 2021 turned into 2022 and global economies continued to open up, creating ever more demand, inflation worldwide continued the steady march higher. Eventually, goods inflation led to faster wage growth and then services inflation accelerated as consumers satiated their appetites for goods and turned their attention towards experiences they had missed during lockdown, such as restaurant meals and travel. Then in early 2022, Russia invaded Ukraine creating an energy-supply worry and another inflationary impulse. Added to the mix of these inflationary conditions, companies seized the opportunity to increase prices beyond their input costs, which resulted in monopolistic corporate “greedflation” (Chart 2). In short, the pandemic set off a global inflationary chain of events which then prompted central banks to aggressively tighten monetary policy with higher interest rates.

Where Is Here?

The current global tightening cycle is in the very late innings with many central banks already hitting pause. Global inflation has been cooling since late last year, as seen in Chart 1, but levels of inflation remain uncomfortably above central banks’ targets, particularly for services. In aggregate, global economies are downshifting, which the IMF forecasts will continue, with global growth expected to slow to 2.7% in 2023 from 3.2% in 2022 and the blistering 6% in 2021. Monetary policy acts with a lag, making it a challenge for central banks to gauge how much economic cooling is still to play out in the months ahead. On the one hand, we can argue the Fed and other central banks should err on the side of caution and avoid forcing their domestic economies into recession now that inflation measures are subsiding. But on the other hand, inflation had been kept tame for over 40 years until the pandemic hit. The current lineup of monetary authorities certainly do not want to go down in history as the ones that ended that impressive track record of success by pausing too early and allowing inflation to reemerge.

Chart 3.

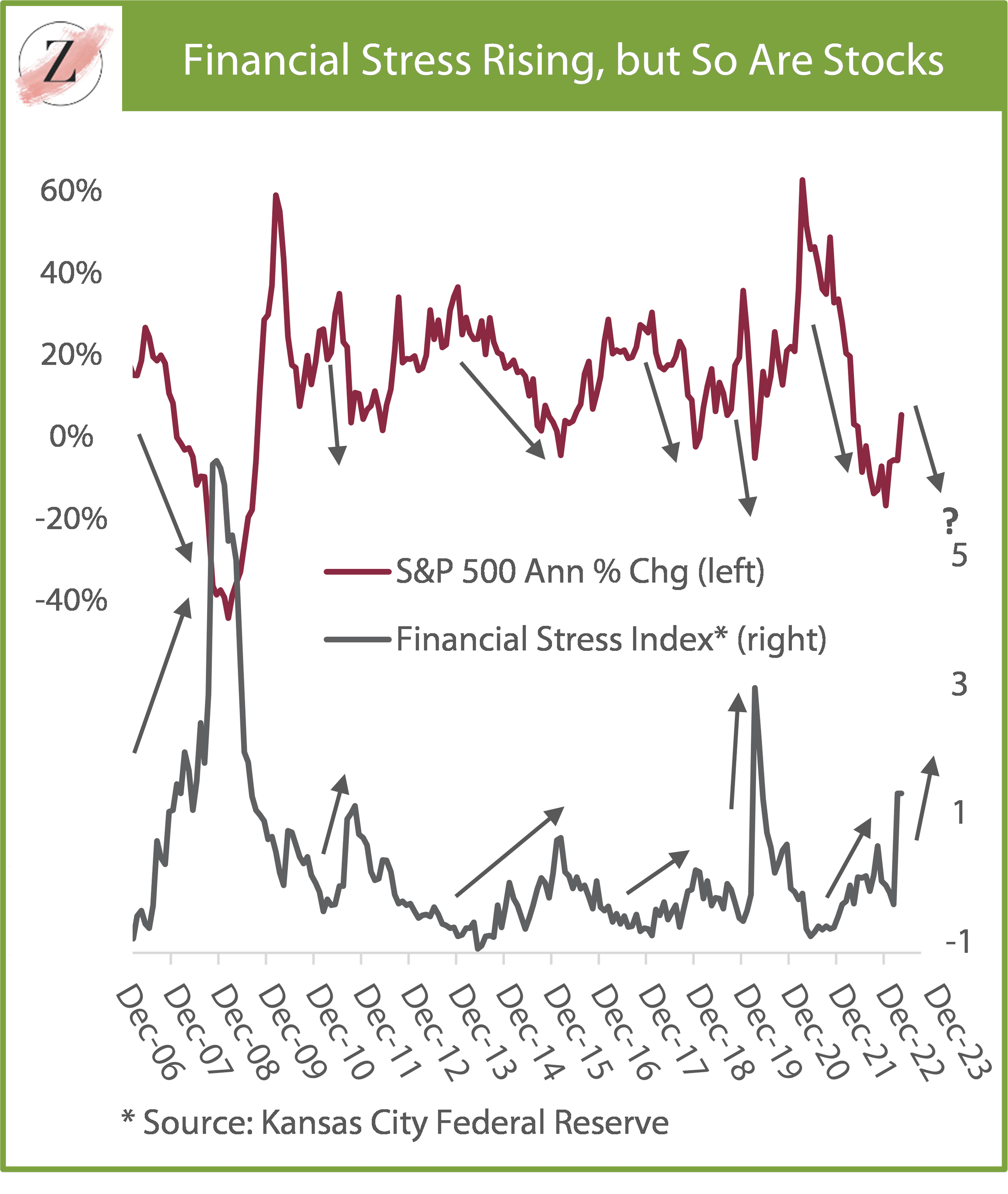

There are clear signs that stress is creeping into the financial markets, but in 2023 this is not being reflected in equity markets broadly. Typically, rising financial stress is accompanied by weak equity markets but not recently (Chart 3). Central banks have a track record of tightening policy until weakness is revealed in some area of the financial system and something breaks. In 2008/2009 it was the sub-prime mortgage fiasco, where rising rates exposed banks’ opaque practice of bundling sub-prime mortgages with prime borrowers. In 1999/2000, the tightening cycle exposed how fragile the unprofitable technology sector was and the dot.com era turned into a dot.bomb. In 2023, there have been several regional bank failures, but they are unlikely to lead to widespread contagion. Banking regulators in the U.S. are working on programs to expand their scope to backstop deposits and prevent widespread bank runs, which seems to be calming jittery depositors and stopping the spread of panic withdrawals.

Chart 4.

Are stocks whistling past graveyards and simply too complacent about the current economic and monetary environment? Or is the market signaling perfect foresight, and this year’s positive performance in stocks is an indication central banks have indeed orchestrated a soft landing? Maybe equity markets reflect expectations that central banks are poised to pause and will quickly reverse course with looser monetary policy? Chart 4 shows the policy interest rates for the U.S. and Eurozone. On average, central banks pause their tightening cycles for only six months before cutting rates, which implies lower borrowing costs later this year is a possibility based on history.

One positive aspect to the current business and investment cycle is the emergence of “rolling recessions,” where certain portions of the economy weaken while others remain robust thereby minimizing economic weakness in aggregate. For example, labor markets remain remarkably strong and are helping to support consumption, but conditions in real estate are signaling recession. The manufacturing sector is contracting according to purchasing managers’ surveys, but non-manufacturing industries continue to expand and support economies as a whole.

Download this market perspective.

Bottom Line

We are over a year into a globally synchronized cycle of rising interest rates. While a recession in the U.S. later this year is quite likely, it is also likely to be mild given the rolling aspect of the current downturn. Some industries will remain buoyant, such that in aggregate growth will be better than when all industries weaken simultaneously. Aggressive central bank rate hikes are finished, with some banks already pausing, some telegraphing they are biased toward pausing, and some lifting rates less aggressively than previously. Nonetheless, global economic activity is losing momentum so government bonds should perform well in the coming months. Meanwhile, earnings and equity markets are likely to be under downward pressure in the near term as economies downshift in response to tighter lending conditions. After all, the Fed is “the law” and, as the song goes, “I fought the law, and the law won.” Beyond the near term, prospects for stocks should brighten with looser monetary policy, improved valuations and a rebound in earnings all providing a positive environment for equity market performance.

Disclosures: Registration with the SEC should not be construed as an endorsement or an indicator of investment skill, acumen or experience. Investments in securities are not insured, protected or guaranteed and may result in loss of income and/or principal. This communication is distributed for informational purposes, and it is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products, or services. Nothing in this communication is intended to be or should be construed as individualized investment advice. All content is of a general nature and solely for educational, informational and illustrative purposes. This communication may include opinions and forward-looking statements. All statements other than statements of historical fact are opinions and/or forward-looking statements (including words such as “believe,” “estimate,” “anticipate,” “may,” “will,” “should,” and “expect”). Although we believe that the beliefs and expectations reflected in such forward-looking statements are reasonable, we can give no assurance that such beliefs and expectations will prove to be correct. Various factors could cause actual results or performance to differ materially from those discussed in such forward-looking statements. All expressions of opinion are subject to change. You are cautioned not to place undue reliance on these forward-looking statements. Any dated information is published as of its date only. Dated and forward-looking statements speak only as of the date on which they are made. We undertake no obligation to update publicly or revise any dated or forward-looking statements.